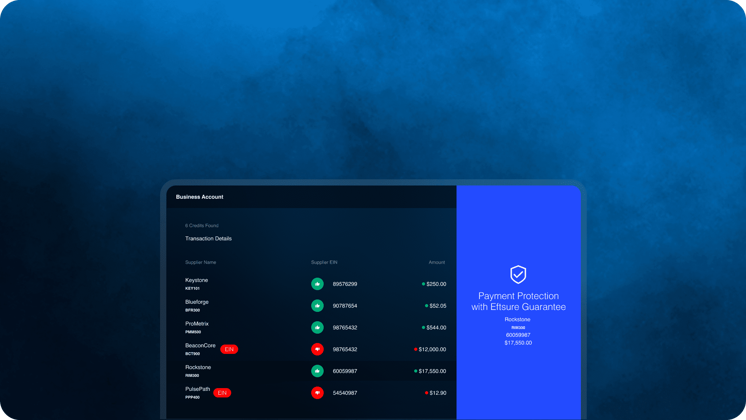

It's a new era in payment protection: Eftsure is joining forces with France-based Sis ID. The French anti-fraud solution was acquired with the goal of integrating the two companies under the Eftsure brand.

So what does that mean? Essentially it means we're now providing payment protection in major markets around the world, including Europe, Australia, New Zealand, the US, India and China—and fully global payment verification coverage is on the horizon.

Founded in 2016 by CFOs and treasurers, Sis ID is a French fintech that helps companies detect fraud and attempted fraud both in France and internationally.

The move follows Eftsure’s 2024 expansion into the US from Australia. It will also see Eftsure and Sis ID become the world's largest business payment protection platform, enabling organizations to validate more vendors and protect more business payments in more markets around the world.

Cross-border solutions have never been more vital. Earlier this year, monthly Eftsure customer data showed the largest ever volume of known fraud attempts since Eftsure was founded in 2014. More broadly, The Australian Competition and Consumer Commission has reported that payment redirection scams were up by 67% to $153m in 2024.

“Fraud tactics are increasingly sophisticated and difficult to detect, with cybercriminals using artificial intelligence tools to produce realistic fake documents and target businesses at scale,” Eftsure CEO, Jon Soldan, said.

“Eftsure and Sis ID share the common goal of preventing these fraudsters from getting a payout. Combining our resources means we'll be able to verify more vendors and protect more payments in more markets around the world, all while keeping pace with a rapidly evolving threat landscape.”

Sis ID CEO, Laurent Sarrat, said the deal made sense because both organisations were focused on helping businesses build cross-border defenses.

“Cybercrime is a global problem and it demands global solutions. Sis ID and Eftsure share a common mission to create collaborative cybercrime solutions that enable business leaders to focus on other priorities,” Sarrat said.

“Sis ID has been working for years to deliver global coverage and verify as many payments as possible. Together with Eftsure, we're well-positioned to offer guaranteed protection for every payment in every market.”

The merger brings together more than 20 years' experience of business payment fraud prevention, a customer base of more than 3,500 organisations, and support offices across the US, Australia and France. This positions the merged entity to service a greater number of large enterprises, especially those that manage global supply chains.

"Finding a company so closely aligned in values and vision is rare," Soldan said. "We share the same perspective on fraud prevention, operational excellence, and what the industry needs to progress. We're incredibly excited about our shared future and our commitment to serving customers on a global scale."