Eftsure has been recognized as a Nacha Preferred Partner across three essential categories: Account Validation, Fraud Monitoring, and Risk and Fraud Prevention.

The partnership underscores our commitment to strengthening the ACH network and protecting businesses from the growing threat of cybercrime and payment fraud.

What is Nacha?

Nacha is the governing body for the ACH Network, the electronic payment system that facilitates direct deposits and direct payments across all US bank and credit union accounts.

The organization develops rules and standards for the network while providing industry solutions, education, and advisory services to payment stakeholders. With 33.6 billion ACH Network payments processed in 2024 valued at $86.2 trillion, Nacha plays a critical role in maintaining the infrastructure that underpins much of America's electronic payment activity, from payroll deposits to B2B transactions.

How Eftsure supports Nacha fraud monitoring rules

Nacha fraud monitoring rules require financial institutions and their partners to implement systems for detecting and preventing fraudulent ACH transactions. These regulations emphasize the importance of real-time monitoring, pattern analysis, and proactive fraud detection mechanisms to maintain the integrity of the ACH Network. Eftsure's platform directly supports compliance with these requirements by identifying potential fraud indicators before payments are processed.

Our fraud monitoring capabilities extend beyond basic compliance, providing businesses with comprehensive protection that aligns with Nacha's evolving standards. By cross-referencing supplier information against multiple databases, Eftsure helps organizations meet their fraud monitoring obligations while reducing false positives (and friction with vendors).

This approach ensures that businesses can maintain efficient payment processes while adhering to the stringent fraud prevention standards that protect the broader ACH ecosystem.

What it means to be a Nacha preferred partner

Nacha's Preferred Partner Program recognizes technology solution providers whose offerings align with Nacha's core strategies to advance the modern ACH Network. Recently, Nacha expanded the program by introducing four new categories, doubling the available designations.

The recognition spans three areas where Eftsure delivers exceptional value.

- Account validation focuses on boosting transaction accuracy and reducing risk through advanced verification technologies, real-time validation, and fraud detection mechanisms. Eftsure's platform excels in this area by cross-referencing payment information in real time, providing businesses with immediate verification of vendor banking details before funds are released.

- Fraud monitoring enhances ACH transaction security through machine learning, real-time data analysis, and behavioral pattern recognition. Our platform analyzes transaction patterns to identify potential threats and suspicious activities, helping businesses stay ahead of evolving cybercrime tactics.

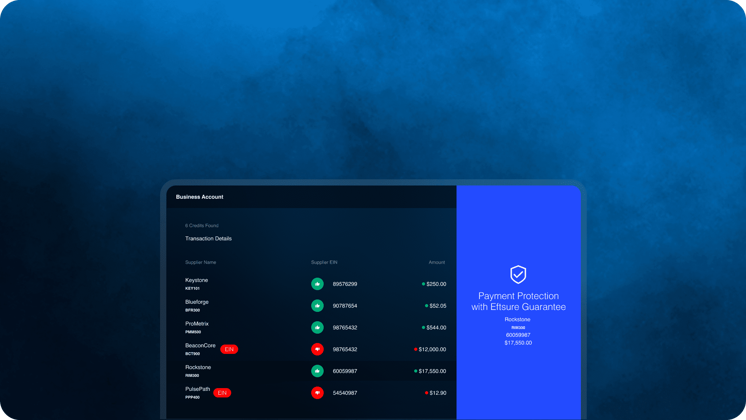

- Risk and fraud prevention involves implementing comprehensive practices, tools, and solutions to mitigate ACH payment risk and fraud. Eftsure's intuitive alert system—green for verified details and red for discrepancies—provides finance teams with clear, actionable intelligence to prevent fraudulent transactions.

Addressing the growing fraud landscape

The timing of this partnership couldn't be more critical. As Jane Larimer, Nacha President and CEO, noted: "As concerns about fraud—particularly check fraud and credit-push frauds such as BEC—continue to grow, being vigilant is ever more important. We welcome Eftsure as a Nacha Preferred Partner and as another line of defense in the war on fraud."

Business email compromise (BEC), fake invoices, insider scams, and duplicate payments continue to plague organizations worldwide. Eftsure's platform specifically addresses these threats by verifying the legitimacy of suppliers and their banking details before any payment is processed. This proactive approach helps businesses avoid costly fraud incidents and maintain the integrity of their payment processes.

Expanding global reach while strengthening domestic security

Our commitment to fraud prevention extends beyond US borders, especially now that we've joined forces with Sis ID and are expanding verification coverage.

"Cybercrime and scam tactics are evolving rapidly, which is why businesses need collaborative, borderless solutions," said Jon Soldan, our CEO. "Our recent expansion with Sis ID empowers US companies with a unique capability: ensuring their vendor payments—whether domestic via ACH, wire payments or international—are directed to the correct recipients."

Supporting ACH adoption and security

Eftsure actively promotes ACH as the preferred payment method within our platform, recognizing the inherent security and efficiency advantages of electronic payments over traditional check-based systems. We encourage businesses to adopt more efficient, more secure payment methods while providing the necessary safeguards to protect ACH transactions.

"Our partnership with NACHA further reinforces the value we deliver to finance teams, particularly in streamlining and securing outbound payments through greater visibility, control, and trust," Soldan added.

Looking ahead

This Nacha Preferred Partner designation illustrates our commitment to continued innovation in fraud prevention and payment security.

As cybercriminals develop new tactics and the payment landscape continues to evolve, we're dedicated to providing businesses with the tools and intelligence they need to protect their payments, vendor relationships, and reputations.